Listing Search

HOME LOANS | 32819 | 32836 | Dr. Phillips

HOME LOANS

Home loans are not issued the way they were in the past. Those bad habit risky loans has come to an end after the housing market crash in 2005. Business is still moving for new buyer's and investors to purchase homes using home loans. however a lot has changed since the housing market crash in 2005 and not as flexible to get a home loan. Homeownership is a sense of pride and many work very hard to have a sense of pride to show their children that it can be accomplished.

HOUSING MARKET CRASH

Housing market crash has changed a lot to protect the banks and public safety. In 2005 the federal government has learned their lesson. Many fraudulent loans with weak lending standards were approved, to include no documentation and non-conforming loans. The majority of bad loans were written off as a loss by all banks involved. Many homes went into foreclosure and short sales.Homeowners walked away with items in home to include anything they can turn a wrench around they lifted up and took it out the house.

Home prices and value of homes spiraled and took a nose dive leading into foreclosures and short sales. This led into a frenzy of investors buying up many investment homes and opened the door for a lot of first time buyers.

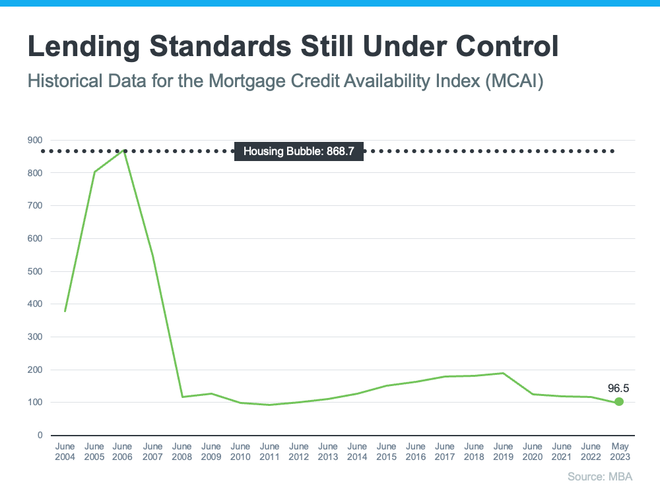

LENDING STANDARDS

The lending standard bar was raised due to 2005 housing market crash. New laws were written and in effect to protect the banks and public sector. Many banks went underwater and had to write off a lot of bad loans that were falsely approved. Many lessons were learned and (PMI) Private Mortgage Insurance was introduced. Based on the sales price of the home, a formula designed determined how much you additional added to your mortgage payment. This is the surplus that provided this happens again, this is already funded. Trust your local home advisor Kevin Strawter at 850 496-6412 or email to steer you in the right direction. Serving Dr Phillips and Central Florida. Click here to know more about Kevin Strawter /ABOUT-KEVIN-STRAWTER-P-A---MRP--GRI--ABR-6-14330.html

TRUSTED ADVISOR

As a trusted advisor, professional realtor and military veteran, I am here to serve you and always on the pulse of the housing market for the Central Florida area. Always stay in tuned, educated, and connected in this volatile housing market to purchase or for the sale of your home. In the absence of trustworthy up to date information whether it's a housing crisis or local housing market, real estate decisions are increasingly being driven by fear, uncertainty and doubt. We as trusted advisors drive the real estate community and always preaching the truth of real estate. I emphasize that education is a must for the community to ensure you are making the right decision. Don't let this shifting housing market delay your dreams, data reveals home values typically appreciate over time and that gives your net worth a nice boost. When you are getting help with a home, look for your realtor with the heart of a teacher. If you are ready to start your journey, contact me today at 850 496-6412 to help begin a new walk to homeownership and all your real estate needs.